Transforming how payments are made across borders between the UK and the GCC

From Days to Seconds

Moneyport PSS reduces cross-border settlement time from multiple banking days to near real-time execution. By removing intermediary delays and manual reconciliation, participants gain faster access to funds, improved liquidity management, and predictable settlement outcomes.

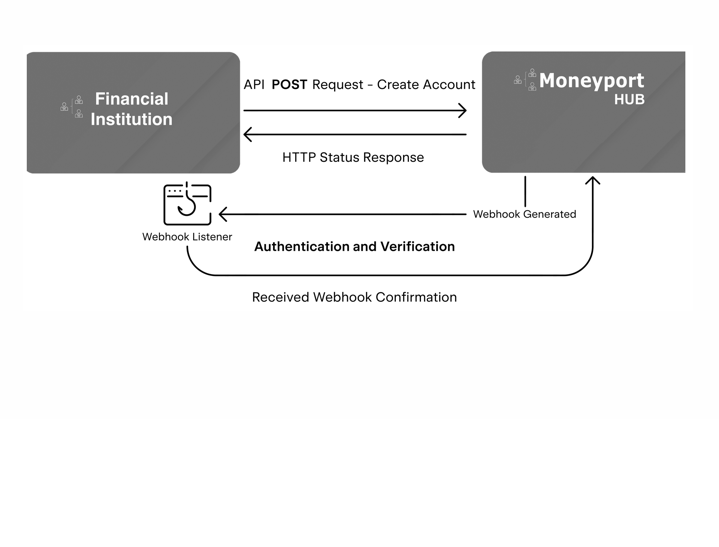

Eliminating Long Transaction Chains

Traditional international payments pass through multiple correspondent banks, increasing cost, delay, and operational risk. Moneyport streamlines this process through a direct settlement layer, reducing intermediaries while improving transparency, traceability, and operational efficiency.

The Future of Cross-Border Payments

Moneyport introduces modern financial infrastructure designed for institutional cross-border flows. Combining API connectivity, ISO 20022 messaging, and programmable settlement logic, the platform enables secure, scalable payments between the UK and GCC financial markets.

What Moneyport PSS Means for Participants

Banks and payment institutions benefit from faster settlement, lower operational friction, and enhanced control over transaction flows. Moneyport provides a secure and auditable environment designed for regulated participants operating across multiple jurisdictions.

Play

Play

Eliminating Long Transaction Chains

Eliminating Long Transaction Chains